Are you planning a trip to France? Discovering travel insurance’s value could make your trip unforgettable. France is famous for its history, beautiful architecture, and amazing food. But, the country’s healthcare and possible travel problems can be tough for visitors.

Travel insurance helps you fully enjoy France with peace of mind. In this guide, we will look at the must-have insurance coverage, the dangers of not having insurance, and picking the best plan for your France trip.

Key Takeaways

- Travel insurance is essential for protecting your trip to France, covering medical emergencies, trip cancellations, and more.

- France often requires travel insurance for short-stay visa applications and entry points in the Schengen zone.

- Comprehensive coverage options like the AXA Platinum Plan offer additional benefits like Cancel for Any Reason and rental car protection.

- Travel insurance rates vary based on factors like coverage, provider, and traveler details, but generally cost 3-10% of your total trip expenses.

- Comparing travel insurance quotes can help you find the right plan to suit your needs and budget for your trip to France.

Why Travel Insurance for France is Essential

Planning a trip to France? Getting comprehensive travel insurance is wise and needed. Although France’s healthcare is top-notch, tourists aren’t covered. This includes a lack of European health insurance cards (EHIC) if you’re not from the EU or have a Schengen visa.

Your U.S. health insurance, like Medicare, won’t cover you across the Atlantic. It’s smart to have travel medical insurance. This ensures you’re financially protected if you face unexpected medical issues during your trip, keeping high costs at bay, especially for pre-existing conditions.

France's Robust Healthcare System

France boasts a renowned healthcare system. Even so, visitors need to pay for their medical care. This is why travel medical insurance is highly recommended.

Without it, medical bills can become overwhelming, especially for complex or long medical treatments.

Risks of Traveling Without Insurance

Heading to France without visitor insurance for France puts you at financial risk. Emergency medical care or evacuations can be extremely costly. Travel insurance, including France Schengen travel insurance, safeguards you against these expenses.

Buying insurance within 15 days of booking secures full benefits, like excluding pre-existing condition clauses. Although policies can be bought up to 24 hours before departure, early purchase brings extra advantages.

Choosing the Right Travel Insurance Plan

When you’re off to France, getting a good travel insurance plan is key. It helps against many troubles, like canceling your trip or sudden health issues.

Comparing Coverage Options

When looking at insurance, focus on what’s important for your France trip. This means checking off things like trip and medical coverage, and protecting your bags.

Numbers from Squaremouth show most travelers paid about $403 in 2023 for full coverage. This includes medical. But if you just wanted medical insurance, the cost was around $96. The cost can vary but is usually between 5% and 10% of your trip’s total cost.

International travel insurance for places like France includes two big areas: Trip Insurance and Travel Medical Insurance. The first helps with costs you can’t get back if your trip is called off for a covered reason. The second ensures you’re cared for medically while away.

- Trip cancellation coverage refunds your money for anything you paid for but can’t use if your plans change due to serious events.

- Trip delay helps with unexpected costs if you’re stuck because of certain reasons.

- Medical expense is vital, making sure you’re covered for health treatment that your usual policy might not handle beyond the US.

- If you need to be moved for medical reasons, medical evacuation and repatriation assist with that cost.

- Baggage coverage makes up for losses in your luggage or if your items are stolen.

Some insurance plans even have a special extra called “Cancel for Any Reason” (CFAR). It lets you back out for personal reasons not included in the usual policy. But remember, CFAR makes the insurance more expensive, by up to 50%.

No matter the choice, travel insurance is peace of mind for your France journey. With good research, you’ll find a plan that covers you where you need and doesn’t break the bank.

Trip Cancellation and Interruption Coverage

As you get ready to travel to France, it’s smart to look into France trip insurance with good trip cancellation and interruption features. This kind of insurance protects you from sudden events that could spoil your trip.

Choosing a plan with a “cancel for any reason” (CFAR) option offers great flexibility. This choice costs more, but it means you can cancel for almost any reason. You can get back up to 75% of what you paid if you cancel at least 48 hours before leaving.

Imagine planning a special trip to Provence for a big anniversary with your spouse. But, you find out your sister is in a bad accident right before you leave. With trip interruption coverage, your insurance would pay for your flight back home and any missed prepaid expenses.

Many full travel insurance plans come with trip cancellation and interruption built in. They help when you have to cancel or cut your trip short because of important reasons, like losing a job or a family crisis.

It’s a good idea to carefully check what each travel insurance plan covers. This way, you make sure your travel to France is protected, making your trip worry-free.

Protecting Your Belongings with Baggage Coverage

When exploring France, worrying about your stuff is the last thing you want to do. Luckily, France travel insurance covers your luggage and personal items. It’s perfect for wandering the markets of Nice or the landscapes in Fontainebleau with peace of mind.

Baggage loss insurance can cover you for $2,500 or more, depending on your plan. Each person is usually covered for $250 to $3,000. You could get between $50 and $250 for each lost item. For special items, like jewelry or electronics, you might get $250 to $500, with payouts up to $2,500.

Lost baggage can be a hassle but having insurance helps. Good news, many plans in France provide money for daily expenses if your bags are late. You might get up to $200 a day. There’s also primary baggage delay coverage available, like with the TripProtector Preferred plan from HTH Worldwide. This means getting money without waiting for other insurance claims.

| Coverage Type | Typical Limits |

|---|---|

| Baggage Loss | $2,500 to $3,000 per person, $50 to $250 per item |

| Baggage Delay | $200 per person per day |

| Specific Item Limit | $250 to $500 per item, $1,000 to $2,500 reimbursement |

Choosing your insurance plan wisely is key. Look for coverage that matches the value of your items. The right policy will protect your things well. Also, keep receipts in case you need to make a claim.

With the right insurance, your trip to France can be worry-free. Enjoy making unforgettable memories without the stress of losing your luggage. Ensure your peace of mind with the perfect travel insurance for your needs.

Medical Expense and Evacuation Protection

Planning a trip to France? It’s crucial to have solid travel medical coverage. Even though France’s healthcare system is top-notch, it could still bring big bills for visitors. A strong travel insurance plan will cover you if a medical emergency occurs on your trip.

Importance of Emergency Medical Care

Travel insurance can help with up to $1 million per person for medical evacuation. This means you can get moved to a better healthcare spot if needed. The cost to be lifted in an emergency ranges from $15,000 to $225,000, depending on where you are. Good plans set different limits for how much they’ll pay for medical help and how much they’ll pay to move you, like up to $500,000 for medical stuff and up to $1 million to be hauled out.

Various travel insurance companies differ in the medical and evacuation benefits they offer. So, it’s wise to look at different options and pick the one that fits your needs and your budget best. Companies like AXA Assistance USA, Cat 70, and GoReady (formerly April) are known for their good insurance coverage for medical and evacuation needs.

It’s a good idea to get both medical evacuation travel insurance and regular travel medical insurance for France. This coverage protects you from unexpected medical costs and helps you get quality care without big out-of-pocket expenses.

| Region | Estimated Medical Evacuation Cost |

|---|---|

| Caribbean and Mexico | $15,000 to $25,000 |

| South America | $40,000 to $75,000 |

| Parts of Europe | $65,000 to $90,000 |

| Asia, Australia, and the Middle East | $165,000 to $225,000 |

Most travel insurance firms offer aid round the clock. They can connect you with doctors, translators, and travel pros to handle emergency medical needs. This is quite helpful in countries like France where the healthcare system may be unfamiliar to you.

Rental Car Insurance Options

Driving around France can be quite freeing. It lets you see more places and at your own speed. But, it’s crucial to choose the right insurance for your rental car. This will protect you and your vehicle while you explore.

Car rental prices often include basic insurance like unlimited liability and fire protection. Yet, you can also get extra insurance options for more safety. These might include coverage for:

- Collision damage waiver and theft protection

- Tire and windshield protection

- Roadside protection

- Personal effects coverage

- Personal injury insurance

Remember, while extra insurance offers more security, it can be more expensive. To get a good deal, compare what different rental companies offer in terms of insurance and pricing.

France travel insurance and France vacation insurance plans could also cover rental cars. This is helpful if you face costs from damages or stolen cars. It adds another layer of protection, reducing your risk of unexpected expenses.

| Insurance Type | Average Daily Cost | Key Features |

|---|---|---|

| Collision Damage Waiver (CDW) | $15-$20 USD | Covers damage to the rental car |

| Theft Protection (TP) | $7-$10 USD | Protects against theft of the rental car |

| Roadside Assistance | $4-$6 USD | Provides coverage for breakdowns and other roadside emergencies |

| Personal Accident Insurance (PAI) | $4-$14 USD | Covers medical expenses for the driver and passengers in the event of an accident |

Knowing the insurance options and their costs helps you make the best choice. This way, your car rental adventure in France will be enjoyable and worry-free.

Cancel for Any Reason (CFAR) Coverage

Planning a trip to France? Consider travel insurance with “cancel for any reason” (CFAR) option. This type of insurance is special. It lets you decide to cancel for any personal reason.

Benefits of CFAR for Flexibility

Picture this: you’re off to a wedding in France. But the wedding is called off. You can use CFAR coverage to change your travel plans. Your insurance may cover some of your nonrefundable costs, offering freedom to alter your plans.

But CFAR has specific rules. You usually need to cancel a set time before your departure. This could be 48 or 72 hours. Also, you might get back only part of what you spent, between 50% and 75%.

| Key CFAR Statistics | Insights |

|---|---|

| Average cost of travel insurance with CFAR | $723 per trip |

| CFAR coverage typically adds 50% to the cost of travel insurance | Adds 6% to 12% to the total trip cost |

| CFAR reimbursement percentages | Range from 50% to 75% |

| Timeframe for cancellation to qualify for CFAR | Usually 48 or 72 hours before departure |

Add CFAR to your France trip insurance for added peace of mind. But be sure to read the policy closely. Knowing what it covers can help you make the most of this flexible option.

“CFAR coverage is the only way to get a partial refund for prepaid nonrefundable trips when canceling for personal reasons.”

travel insurance for France: Cost Considerations

Factors Affecting Premiums

When you head to France, getting travel insurance is a must. It protects your trip money and makes traveling worry-free. The price of France travel insurance can be from $10 to $50 for a week, based on several factors.

Costs depend on how long you’ll be in France, your age, what coverage you need, and your chosen deductible. Choosing a broader plan or if you have medical issues might increase the cost.

If you visit France often, consider yearly, multi-trip insurance for the Schengen Zone. This avoids the need to buy a new policy each time you visit. These policies cover your whole trip.

The French healthcare system ranks among the top globally. It covers everyone, offering 70% back on medical fees. Still, if you need to stay in the hospital, it could get expensive. This is why good France holiday insurance is vital.

| Traveler Age | Trip Duration | Trip Cost | Premium Cost |

|---|---|---|---|

| 30 years old | 10 days | $4,000 | $30 |

| 45 years old | 2 weeks | $5,500 | $45 |

| 60 years old | 1 week | $3,000 | $40 |

Knowing what affects travel insurance prices helps you choose wisely. You’ll find the best fit between what you need and your budget for France travel insurance.

Comparing Travel Insurance Quotes

When you plan a trip to France, getting the right travel insurance is key. It protects you from unexpected surprises. It’s important to compare quotes from various insurers to find the best deal. TravelInsurance.com helps by gathering quotes from top companies. This lets you pick the ideal policy for your France trip.

Our site has many travel insurance options. This includes plans for trip cancellations, lost baggage, medical expenses, and emergency evacuations. No matter how you travel, you can find suitable coverage and prices. We also help those with health conditions and those wanting France travel insurance that covers any reason for canceling.

| Insurance Provider | Coverage Limits | Pricing (per person) |

|---|---|---|

| Patriot International Lite | $100,000 medical, $500,000 evacuation | $45 for 7 days |

| Diplomat International | $500,000 medical, $500,000 evacuation | $79 for 7 days |

| Geoblue Voyager Choice | $1,000,000 medical, $500,000 evacuation | $99 for 7 days |

| Geoblue Voyager Essential | $250,000 medical, $500,000 evacuation | $59 for 7 days |

Finding the right travel insurance for your France visit depends on many factors. Think about how long you’ll stay, your planned activities, and your health. Our licensed agents are ready 24/7 to help you find the best France Schengen travel insurance plan.

“TravelInsurance.com has been a lifesaver when it comes to finding the right coverage for my trips to France. The platform’s user-friendly interface and comprehensive policy options make it easy to compare and select the best plan for my needs.”

Alternative Coverage Sources

When planning your trip to France, look beyond the usual travel insurance. Check alternative sources to get more coverage and possibly save money on your trip.

See if your credit cards or health plans offer travel benefits. Some cards include rental car insurance or trip protection. Also, your health plan might cover medical costs overseas.

Consider getting travel insurance from your airline or travel site. They might offer packages that cover flights, hotels, and more. Buying this way could be cheaper and easier than shopping around for separate plans.

Always read the fine print to know what’s covered. Make sure it meets your needs for travel insurance for France trips.

Comparing and Buying Travel Insurance

If you want a special travel insurance plan, compare prices from different companies. Sites like Compare & Buy Travel Insurance For 2024 make this easy. They let you check out plans from 22 top insurers to find one that fits your travel insurance for France trips need and budget.

Keep in mind, prices for travel insurance for France trips can change a lot. Your age, how long you’re staying, where you’re going, and the plan you choose all affect the price. Look around before you buy, so you pick the best coverage for the best price for your trip to France.

Travel Safety Tips for France

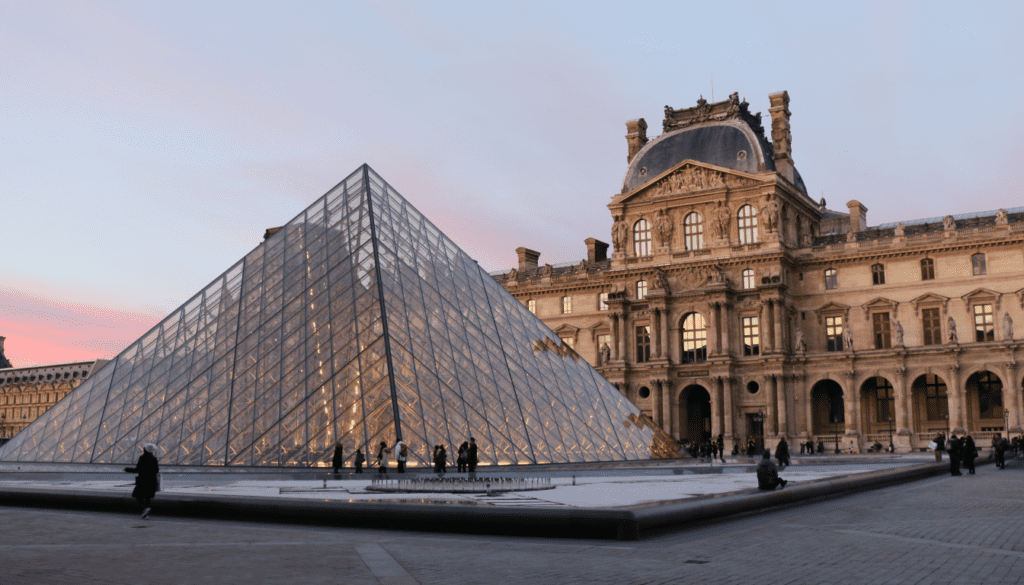

France is seen as a safe place in Europe. Yet, you should stay watchful and prepare well for your journey. It doesn’t matter if you’re at the famous Louvre in Paris or exploring Marseille’s streets. Being alert and joining trusted tours will help you stay safe.

Staying Vigilant in Tourist Areas

Even though France has low crime, places like Paris and Marseille see some thefts. To stay safe, keep your stuff close and don’t show off valuable things. Always be aware of your surroundings, especially where it’s crowded. The the U.S. Department of State lists France at a Level 2 travel advisory, recommending increased caution due to the risk of terrorism and civil unrest.

Booking Reputable Tours and Excursions

Joining tours from a trusted company can make your trip better and safer. Tours lead you to famous spots, like the Louvre and the French Riviera’s beautiful beaches. It’s smart to pick tours and day trips your hotel or travel agent suggests. This way, you know you’re with a reliable team.

“Comprehensive travel insurance can provide valuable protection for your trip to France, covering potential disruptions, medical emergencies, and other unforeseen events.”

Being cautious in tourist areas and choosing good tours ensures you see the best of France while staying safe. Always plan ahead, and a safe and memorable trip to France is yours.

COVID-19 Requirements for France

As the world deals with the pandemic, it’s key for travelers heading to France to keep up with recent entry rules. France has mainly lifted its COVID-19 travel limits for visitors from abroad. Still, it’s smart to stay updated on any changes in the country’s rules.

For those going from the U.S. to France, no travel insurance is needed right now. However, picking up a good travel insurance plan is a smart move. It can pay for unexpected medical bills, help if your trip gets canceled, and protect your stuff and rental cars.

“The Diplomat Long Term travel insurance offers coverage for COVID-19 and insures up to 1 Million Dollars.”

Anyone needing a visa to France must get travel insurance that follows the Schengen visa rules. In 2024, this insurance might cost between $63 and $105, depending on several things like the traveler’s age and the trip length.

Here are some well-known travel insurance choices for trips to France that meet the Schengen visa demands:

- IMG Patriot International Lite, good for the sudden start of health issues

- Safe Travels International, with top-quality medical help in Europe and coverage for health issues that unexpectedly come back

- Atlas International Insurance, for the sudden start of health issues

- Travel Medical Choice, with up to $5 million coverage and help for the sudden start of health issues

When looking at a travel insurance plan for your visit to France, think about things like how much the plan covers, what medical benefits it offers, and if it includes pre-existing conditions. Picking the right insurance will help you have a worry-free visit to France.

Conclusion

Travel insurance for my trip to France is really important. It offers protection and peace of mind. The cost might seem high, but it’s worth it. The average claim payout in 2022 was $2,157. This shows how crucial insurance is while traveling.

It’s key to compare different travel insurance options. For France, I need to make sure I have the right health insurance if I’m not from the EU. A policy should cover trip interruptions, medical issues, and lost baggage. The right plan will let me enjoy my trip to France without worries.

I’m glad there are resources to help with my France travel insurance. They help me make a smart choice. I’m choosing good insurance to be safe and not worried. This way, I can focus on making great memories in France. Buying travel insurance is a personal choice. But for me, it’s essential for a worry-free trip.

FAQ

Why is travel insurance essential for a trip to France?

Travel insurance is key in France as it covers medical issues, cancellations, and lost items. You won’t be covered by French health care as a tourist. So, it’s vital, especially without a Schengen visa.

What should I look for in a travel insurance plan for France?

Look for plans that cover trip cancellations, medical expenses, and baggage. For more flexibility, add cancel for any reason (CFAR) as an upgrade.

How does travel insurance protect my belongings in France?

If things like your handbag or camera are lost or stolen, your insurance can help. Always make a report with the police and keep all your documents to claim.

What medical coverage should I have for a trip to France?

Ensure your insurance covers at least 0,000 for medical expenses. This helps with emergencies, doctors’ visits, or returning home for medical reasons.

How does travel insurance cover rental cars in France?

Insurance plans might help with rental car damage or theft fees in France. They include collision coverage and theft protection, among others.

What is “cancel for any reason” (CFAR) coverage, and how does it benefit me?

CFAR allows you to cancel your trip for any reason, giving maximum flexibility. Yet, this extra flexibility costs more.

How much does travel insurance for a trip to France typically cost?

The average price is about 6. Your cost will vary with your age and the trip’s total cost.

What are some safety tips for traveling to France?

While France is mostly safe, be careful in tourist areas to avoid pickpocketing. Use trusted tour providers and steer clear of protests or heavy police zones.

What are the current COVID-19 requirements for travel to France?

French travel restrictions for COVID-19 have been lifted. Always check for updates on local policies before you go.